Having the purpose of making it as simple to go with as possible, we generated this PDF editor. The whole process of filling out the aml compliance program template for money services business is going to be straightforward in the event you comply with the next steps.

Step 1: Click on the button "Get Form Here".

Step 2: When you have accessed your aml compliance program template for money services business edit page, you'll discover all actions it is possible to undertake regarding your file at the top menu.

The next parts will frame the PDF document that you will be completing:

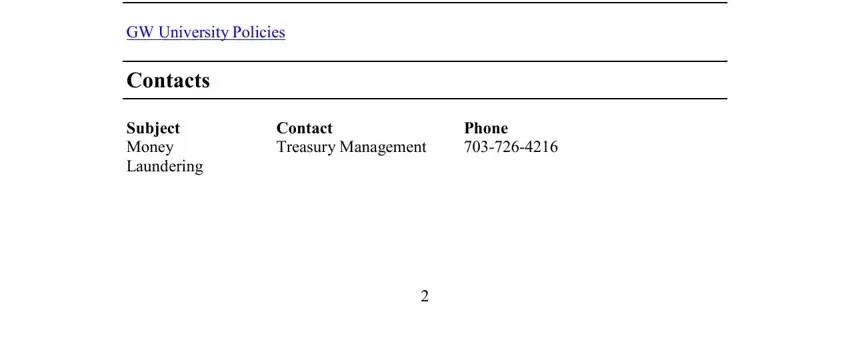

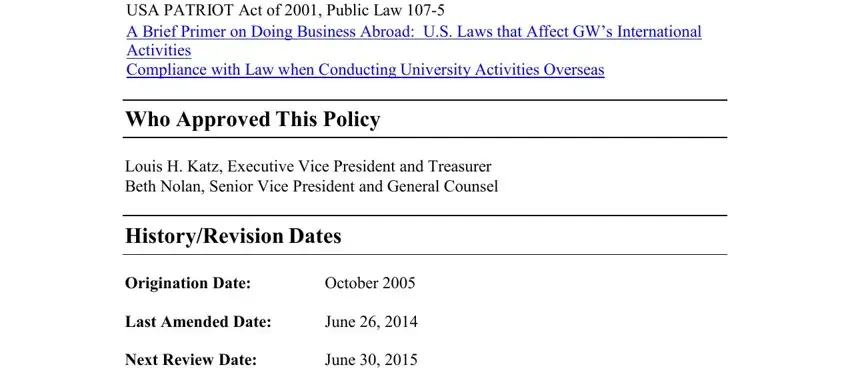

Jot down the details in Bank Secrecy Act USC et seq USC, Who Approved This Policy, Louis H Katz Executive Vice, HistoryRevision Dates, Origination Date, October, Last Amended Date, June, Next Review Date, and June.

Step 3: Choose the "Done" button. So now, you may export your PDF document - upload it to your device or forward it by using electronic mail.

Step 4: In order to avoid any problems in the long run, try to prepare at the very least several copies of your form.